1. In 2008, United Airlines mishandled and broke musician Dave Carroll’s $3,500 guitar. After nine months of fruitless negotiations with the airlines, he wrote a song about his experience which went viral, causing a 10% drop in UAL’s stock price and a loss of $180 million within four weeks.

In 2008, Dave Carroll took a flight from Halifax Stanfield International Airport to Omaha, Nebraska’s Eppley Airfield. During a layover at Chicago O’Hare International Airport, he allegedly heard one of the co-passengers talk about the baggage handlers throwing the guitars on the tarmac. He discovered that his $3,500 Taylor guitar was indeed severely damaged. Though Carroll filed a claim with the airlines, they informed that he was ineligible for compensation as he didn’t make the claim within 24 hours.

Following nine months of indifference from the airlines, Carroll wrote a song titled United Breaks Guitars with the refrain “I should have flown with someone else, or gone by car, ’cause United breaks guitars.” Its video was posted on YouTube on July 6, 2009, and immediately went viral getting half a million views in just three days, 5 million by mid-August, 10 million by February 2011, and 15 million by August 2015. It prompted an apology from United’s managing director and a compensation of $3,000 donated to the Thelonious Monk Institute of Jazz, but it was too little, too late. The airlines suffered severe losses financially and to its reputation.(source)

2. In 1982, Mars, Inc. refused the offer to include M&M’s in the movie E.T.: The Extra-Terrestrial. Its competitor Hershey was approached to include Reese’s Pieces, resulting in a 65% increase in its sales.

In the film, 10-year-old Elliott leaves Reese’s Pieces candy to lure the reluctant alien into his house despite his family’s disbelief that it was hiding in their shed. Mars, Incorporated refused to let M&M’s be used in the film because they thought E.T. would frighten children. Hershey did not have to pay for the inclusion of its candy in the movie. But, it agreed to a tie-in to promote the movie with $1 million of advertising and in return was allowed to use E.T. to advertise its own product.(1,2)

3. Despite introducing the first desktop computer with a GUI and a mouse called the Alto in 1973, Xerox chose to produce a text-based machine. Meanwhile, Apple’s Macintosh revolutionized the PC market with its bitmap display and mouse, both copied from the Alto.

The Xerox Alto was introduced on March 1, 1973, a decade before computers with a graphical user interface (GUI) were introduced to the mass market. The Alto used a custom, multi-chip CPU that could fill a small cabinet. In the beginning, only a handful of the machines were produced, but by the late 1970s over a thousand were used at Xerox labs and a 500 more in various universities, totaling up to 2,000 machines.

Its popularity in Silicon Valley for its GUI interface attracted Steve Jobs who arranged a visit for Apple engineers to Xerox PARC (Palo Alto Research Center Incorporated) and a demonstration of the technology. Two visits later, they introduced Apple Lisa and Macintosh systems. However, Xerox itself showed no interest in the research and instead opted for a conventional model with no mouse and the standard 80 by 24 character-only monitor. By the time Xerox realized their mistake in the 1980s, Apple’s machines were already in the market. Though they did introduce a new GUI-based system called Xerox Star, it was expensive and could not compete with other, cheaper options.(source)

4. In 2003 when eBay was launched in China, it spent $100 million to fend off competition from Alibaba. However, eBay charged the sellers for listing their product while on Alibaba it was free. This resulted in 43% drop in market share and eventually the closure of eBay’s China operations in 2006.

When eBay was launched in China as “eBay EachNet,” Alibaba launched its own auction site called “Taobao.” Soon, eBay started an aggressive campaign to dominate the market by signing exclusive rights with major portals to block ads from Taobao and spread its own ads everywhere. Alibaba instead secured ads on TV knowing most people would watch the TV rather than browse the internet. While eBay kept the website listings product-centric, Alibaba kept them customer-centric and allowed the user flexibility on how long the product could be listed. By March 2006, Alibaba had 67% market share in terms of users while eBay’s share decreased to 29% causing it to withdraw its operations in China by December.(source)

5. In 2001, a Tokyo-based stock trader accidentally sold 610,000 shares at six yen when he was supposed to sell six shares for 610,000 yen. This cost his company US$100 million.

The Tokyo-based trader was working for UBS Warburg, a Swiss global financial company. The shares belonged to a Japanese advertising agency known as Dentsu which had newly debuted on the Tokyo Stock Exchange. Even though the trader’s fat-fingered error was spotted immediately, the transaction was not canceled by the stock exchange, forcing UBS to buy back the shares at market-value and incur a loss of US$100 million. The trader is believed to have resigned after he realized the mistake.(1,2)

6. Excite, one of the most recognized brands on the internet in the 1990s, was offered an opportunity to buy Google for $1 million because Sergey Brin and Larry Page wanted to focus on their studies. In 2001, Excite filed for bankruptcy and was bought by Ask Jeeves.

Founded in 1994, Excite is a collection of websites and online services. In 1998, after suffering a loss of $30.2 million, Yahoo! wanted to purchase it for $6 billion, but its CEO George Bell chose @Home Networks to acquire the company. In 1999, the then Stanford University graduate students Sergey Brin and Larry Page felt Google was taking up the time they needed to study. So, they went to Bell and offered to sell it for $1 million. Bell turned it down and even threw Excite @Home’s venture capitalist Vinod Khosla out of his office for negotiating the price down to $750,000.

In October 2001, Excite filed for bankruptcy and was purchased for $2.4 million by its founders. It was again acquired by iWon.com and yet another time in March 2004 by Ask Jeeves. All the mergers failed to rejuvenate Excite which now had to race against Google and Yahoo! in building a search feature. By 2010, Google became a $180 billion company and, according to Justin Rohrlich of Minyanville.com, Excite’s failure to acquire it was considered a “stupid business decision.”(source)

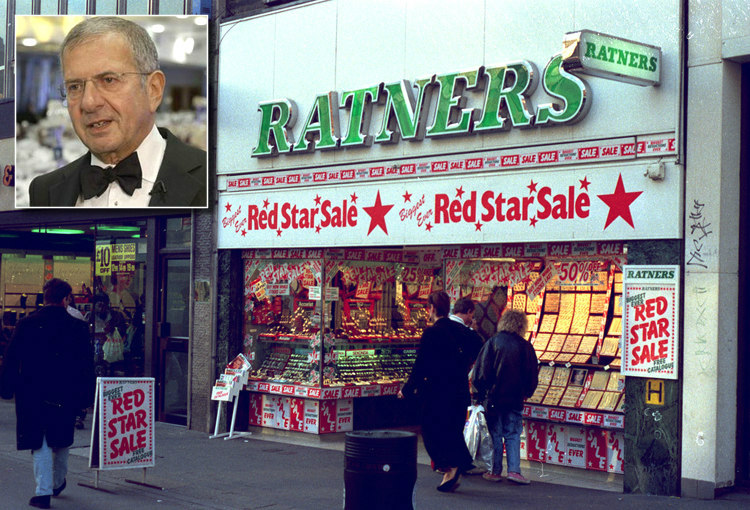

7. During a speech in 1991, the CEO of Britain’s major jewelry company, the Ratners Group, commented on the products saying, “People say, ‘How can you sell this for such a low price?’ I say, ‘Because it’s total crap.’ ” Subsequently, he was fired, and the company lost £500 million and nearly collapsed.

Gerald Ratner is the founder and former chief executive of Ratners Group, a group of shops in Britain and over a 1,000 in the U.S. He attracted his customers by using fluorescent orange posters advertising discounts, and though the products were considered tacky, they were popular in the public until his speech to a conference of the Institute of Directors at the Royal Albert Hall on April 23, 1991. He said,

We also do cut-glass sherry decanters complete with six glasses on a silver-plated tray that your butler can serve you drinks on, all for £4.95. People say, “How can you sell this for such a low price?”, I say, “because it’s total crap.”

He also added that a pair of earrings was “cheaper than an M&S prawn sandwich but probably wouldn’t last as long.” His comments made the Group extremely unpopular and became a textbook example of why CEOs should their words carefully. Now, a company’s near collapse or suffering under similar consequences is called the “Ratner Effect.” Ratner himself was nicknamed “The Sultan of Bling,” and gaffes such as his are often referred to as “doing a Ratner.”(source)

8. Kodak developed the first digital camera in 1975, but kept it a secret fearing it would threaten their photographic film industry. Eventually, the competitors who did market digital cameras drove Kodak to bankruptcy.

Following the development of the digital camera, Kodak’s core business faced no pressure from competing technologies. There was no incentive to manufacture digital cameras as the company’s executives believed people preferred traditional film cameras, and no one would want the digital ones. After a drop in sales of films in 2001, Kodak hoped to again lead in the market through aggressive marketing of digital cameras. They managed to secure second place in U.S. digital camera sales, with Sony in the first place, but to do that they had to lose $60 for every camera sold.

Kodak also spent a lot of resources in studying customers and found that many digital camera users found it difficult to share the photos they took on their computers. They used this as an opportunity to develop various, innovative, supporting products such as a printer dock in which you could insert the camera and print out photos. These products provided some respite, but Kodak had already arrived too late and couldn’t compete with Asian competitors. By 2010, Kodak was in seventh place behind Canon, Sony, Nikon, and others. It did not help that eventually standalone digital cameras were replaced by smartphone cameras.(source)

9. In 2000, Blockbuster turned down the chance to buy Netflix for $50 million because the CEO thought it was a “very small niche business.” Instead, Blockbuster chose Enron, which filed for bankruptcy the following year.

Netflix was founded in 1997 when a customer of Blockbuster, Reed Hastings, went to return Apollo 13 six weeks late only to find that he had to now pay $40 for it. That gave him the idea of starting his own company where you could pay a fixed fee per month and watch “as little or as much as you wanted.” In 2000, Hastings approached Blockbuster to sell his company for $50 million, but the offer was rejected. By 2005, Blockbuster faced a controversy and was being investigated by three state attorneys general who argued: “that customers were being automatically charged the full purchase price of late rentals and a restocking fee for rentals returned after 30 days.”

In 2002, Blockbuster faced a similar lawsuit which was settled by paying $9.25 million in attorney’s fees and offering $450 million in late fee refund coupons which were actually only given if the customers rented another video. In 2010, late fees were reintroduced. In January 2013, Deloitte was appointed as company administrators and announced the closure of 160 stores in the U.K., and a further 164 were closed in February. Though Blockbuster changed administration to Gordon Brothers Group in March, by December, all stores were closed as no one would buy the company.(1, 2)

10. In 2014, London’s black cabs protested against Uber by bringing gridlock across central London. Instead of damaging Uber, there was an 850% increase in app downloads resulting in the downfall of black cabs.

London was the 11th city that Uber started operating in, and at that time, its main competitors were Addison Lees and the expensive but convenient black cabs. Over 9,000 of the black cab drivers were already signed up for ride-hailing apps by Hailo. Addison Lees had 4,500 cars, and around 3,000 were licensed, private-hire operators. Following months of unease about Uber among the black cab riders, a planned protest was held on June 11, 2014. Between 4,000 to 10,000 drivers stopped working and turned their car sideways on Lambeth Bridge causing gridlock from Westminster to as far as Piccadilly Circus. However, their protest only served as an advertisement for Uber increasing its popularity and downloads.(source)

No comments:

Post a Comment